Ready to earn more with your AVAX (Avalanche)? Liquid staking allows you to earn rewards while maintaining access to your funds. This comparative review and instructional guide explores two popular options: BENQI and Gogopool, highlighting their strengths and weaknesses to help you choose the best platform for your needs.

Understanding Liquid Staking on Avalanche

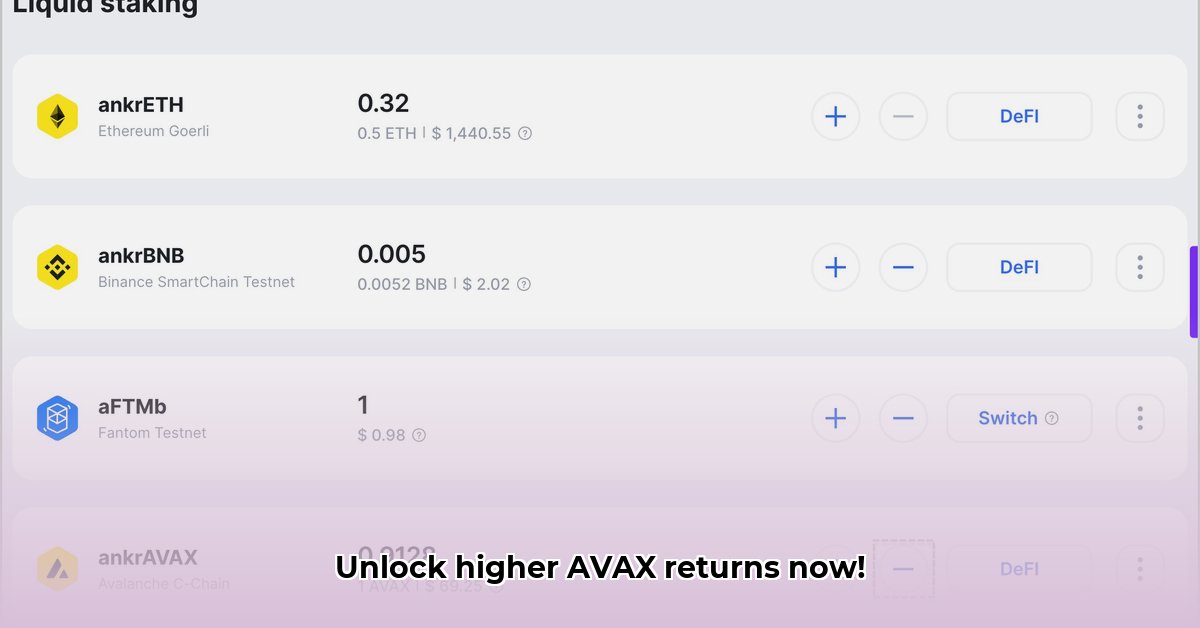

Liquid staking offers a compelling alternative to traditional staking. Instead of locking your AVAX for an extended period, you receive a representation token (e.g., sAVAX from BENQI, ggAVAX from Gogopool). This token mirrors the value of your staked AVAX but offers liquidity, allowing you to use it in other DeFi protocols. Want to earn yields and maintain access to your capital? Liquid staking provides a solution.

BENQI vs. Gogopool: A Comparative Analysis

Both BENQI and Gogopool offer liquid staking for AVAX, but their features and user experiences differ significantly. This comparison examines key aspects to help you make an informed decision.

Security: Protecting Your Investment

Security is paramount in the cryptocurrency world. Both platforms claim robust security measures, including regular security audits. However, the frequency and scope of these audits may vary. It's crucial to independently verify the security protocols and review available audit reports before committing your AVAX. Remember, a transparent platform readily shares its security measures and audit findings.

User Experience: Ease of Use and Accessibility

BENQI, particularly when integrated with Zerion, generally receives higher marks for user-friendliness. The combined interface simplifies the staking and unstaking process, making it accessible even to crypto newcomers. Based on available information, Gogopool's user experience may be less intuitive. If ease of use is a priority, BENQI’s integration with Zerion offers a significant advantage.

Yields (APY) and Fees: Maximizing Your Returns

The annual percentage yield (APY) offered by BENQI and Gogopool fluctuates based on market conditions and staking participation. While both frequently provide competitive APYs (often in the 5-7% range), it's essential to check their current rates before making a decision. Factor in any transaction fees, as these can impact your overall returns. Always stay informed about current APY rates and fee structures.

Liquidity and Withdrawal Speed: Accessing Your AVAX

Liquid staking allows relatively quick access to your AVAX, but the speed of withdrawal differs between platforms. BENQI generally facilitates withdrawals within approximately two weeks. The withdrawal timeframe for Gogopool requires verification on their platform. Consider your liquidity needs when selecting a provider – faster withdrawal times provide more flexibility.

Risks: Navigating the Challenges of Liquid Staking

While liquid staking offers substantial benefits, inherent risks must be considered:

- Smart Contract Vulnerabilities: Like all software, smart contracts are susceptible to bugs. Thoroughly investigate the security audits and updates before participating.

- Market Volatility: The value of your liquid staked AVAX tokens is susceptible to market fluctuations, impacting your overall returns.

- Validator Issues: Your staked AVAX is delegated to validators maintaining the Avalanche network. Validator performance can affect your rewards. Choose reputable, established validators.

- Impermanent Loss (IL): This risk solely applies if you utilize your liquid staked tokens in DeFi protocols like AMMs. Changes in the relative prices of the tokens can result in fewer AVAX than initially staked.

- Regulatory Uncertainty: The evolving regulatory landscape for cryptocurrencies could impact liquid staking platforms.

BENQI Liquid Staking via Zerion: A Step-by-Step Guide

This guide outlines how to liquid stake AVAX using BENQI through the Zerion interface:

- Obtain a Zerion Wallet: Download and create a Zerion wallet account if you don't already have one.

- Connect Your Wallet: Link your preferred wallet to your Zerion account.

- Locate BENQI: Find BENQI within the Zerion interface.

- Deposit AVAX: Transfer AVAX from your wallet to your Zerion wallet.

- Stake Your AVAX: Use the BENQI interface (via Zerion) to stake your AVAX and receive sAVAX tokens.

- Manage Your sAVAX: Utilize your sAVAX tokens while your original AVAX continues earning rewards.

Choosing the Right Platform: Your Personalized Strategy

The table below summarizes the key differences between BENQI and Gogopool:

| Feature | BENQI | Gogopool |

|---|---|---|

| User-Friendliness | Excellent, especially via Zerion | Requires further investigation |

| Security | Strong; verify audits independently | Requires further due diligence |

| APY | Competitive (check current rates) | Competitive (check current rates) |

| Withdrawal Time | Approximately 2 weeks | To be determined on their platform |

| Risk Tolerance | Generally lower (using Zerion) | Potentially higher |

Disclaimer: APYs and other details are dynamic. Conduct thorough research before investing. Only invest what you can afford to lose.

Key Takeaways and Actionable Recommendations

Choosing between BENQI and Gogopool depends on your individual needs and risk tolerance. Prioritize platforms with transparent security practices and readily available audit reports. Consider your technical comfort level and desired liquidity when making your decision. Remember to diversify your investments and stay informed about the ever-changing DeFi landscape.